Super contributions explained . . . easily

The superannuation rules have become simpler and more generous over the years, but understanding what they mean for you can still seem confusing.

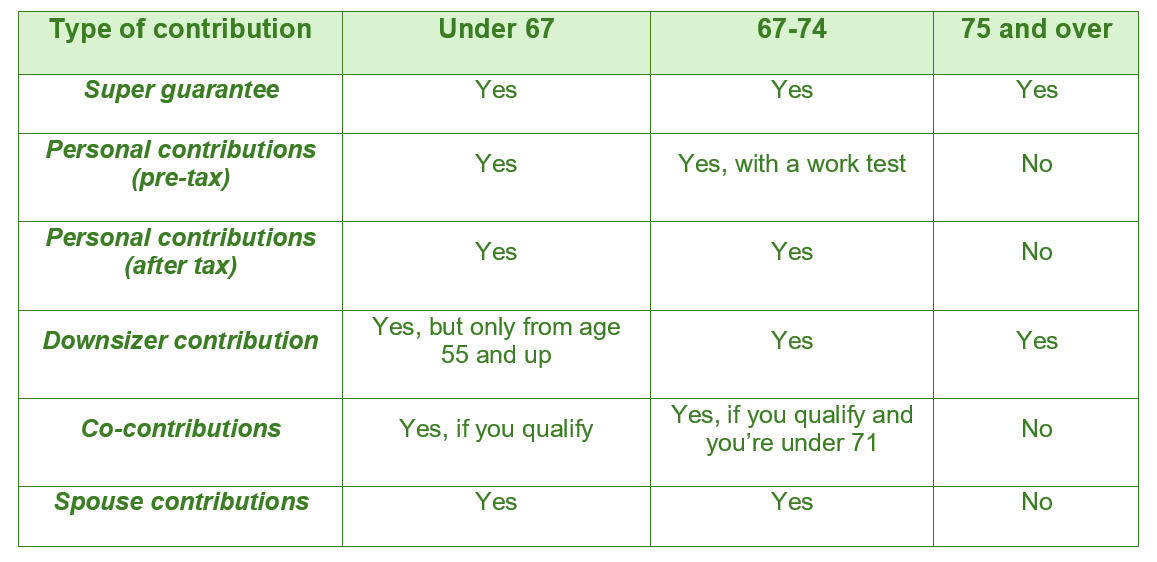

Here is a simple explanation of super contributions. Just refer to the table below for specific details and read further for a longer explanation under the age group that relates to you.

Major types of super contributions

Firstly, a quick explanation of the different types of super contributions available:

Super Guarantee (SG)

Employers must pay the superannuation guarantee for their employees, currently set at 11.5% p.a. of the employee’s earnings. This will rise to 12% from 1st July 2025, but following that there are no further increases planned. These are classed as concessional contributions, and are, along with your Pre-tax personal contributions (see below), are currently capped at $30,000 per year.

Pre-tax contributions

You can make additional voluntary contributions deducted from your salary by your employer, thus reducing your taxable income. As with your SG contributions (above), these are classed as concessional contributions, and are currently capped at $30,000 per year. However, if you have unused cap amounts from previous years, you may be able to carry them forward to increase your contribution caps in later years (as always, conditions apply). Concessional contributions are taxed at only 15% when received into your super fund.

Personal contributions (after tax)

Personal contributions for which you do not claim a tax deduction are classed as non-concessional contributions. You can contribute a maximum of $120,000 per year, but you may be eligible for a bring-forward arrangement allowing you to make up to three years’ worth of contributions in the first year of a three-year period (as with the carry forward cap, conditions apply).

Downsizer contribution

Allows those aged 55 or older to contribute up to $300,000 from the proceeds of selling their home into their superannuation, provided the home has been owned for at least 10 years; this contribution is not subject to the usual contribution caps and does not require the purchase of another property.

Government co-contributions

Subject to restrictions on your annual income, if you make a personal contribution to your super, the government may make an additional contribution of up to $500 per year.

Spouse contributions

You may be able to claim a tax offset against your own income if you make a contribution to your spouse’s super.

Age eligibility for super contributions

In more detail . . .

If you are under 67

The rules are clear. You can make or receive any type of contribution described above.

However, the government co-contribution is targeted at low to middle income earners so not everyone qualifies. To receive any co-contribution, you must earn at least 10% of your income from employment, including self-employment, have income of less than $62,488 p.a. and make a personal contribution. When you lodge your tax return, the ATO will calculate your co-contribution (maximum $500) and pay it into your fund.

If you make a contribution for your spouse, he or she must meet the under-75 age requirement and earn less than $40,000. For a contribution of $3,000 the contributing spouse can receive up to an 18% tax offset, knocking up to $540 off their tax.

Workers with income of less than $37,000 may receive a government contribution of up to $500 to their superannuation savings through the Low-Income Super Tax Offset (LISTO). This is to offset the 15% contributions tax paid by the fund on a low-income earner’s contributions and aims to ensure they pay no tax on SG contributions.

From Age 55, to utilise the Downsizer Contribution, you or your spouse must have owned the home for at least 10 years, and the sale proceeds must be exempt or partially exempt from capital gains tax under the main residence exemption (or would have been if the home was acquired before 20 September 1985). Additionally, the downsizer contribution must be made within 90 days of receiving the sale proceeds, and you cannot have previously made a downsizer contribution from another home. Both individuals of a couple can make their own Downsizer contribution.

If you are 67 to 74

If you are working, your employer will still pay the superannuation guarantee and you can make extra contributions such as salary sacrifice. However, to make a personal contribution or receive a contribution from your spouse, you need to be working.

To satisfy the work test, at sometime in the financial year, you must be gainfully employed (earning money) for 40 hours over any 30-day period. You could do it all in one week or work ten hours a week for four weeks.

If you are 75 or over

You can receive the superannuation guarantee (SG) and also make personal contributions funded from selling your home and downsizing (‘downsizer contribution’).